How to Bridge from Astar Network to Arbitrum

Celer cBridge makes it quick, easy, and secure to bridge assets from Astar Network to Arbitrum and from Arbitrum to Astar Network by following these simple steps:

Step 1:

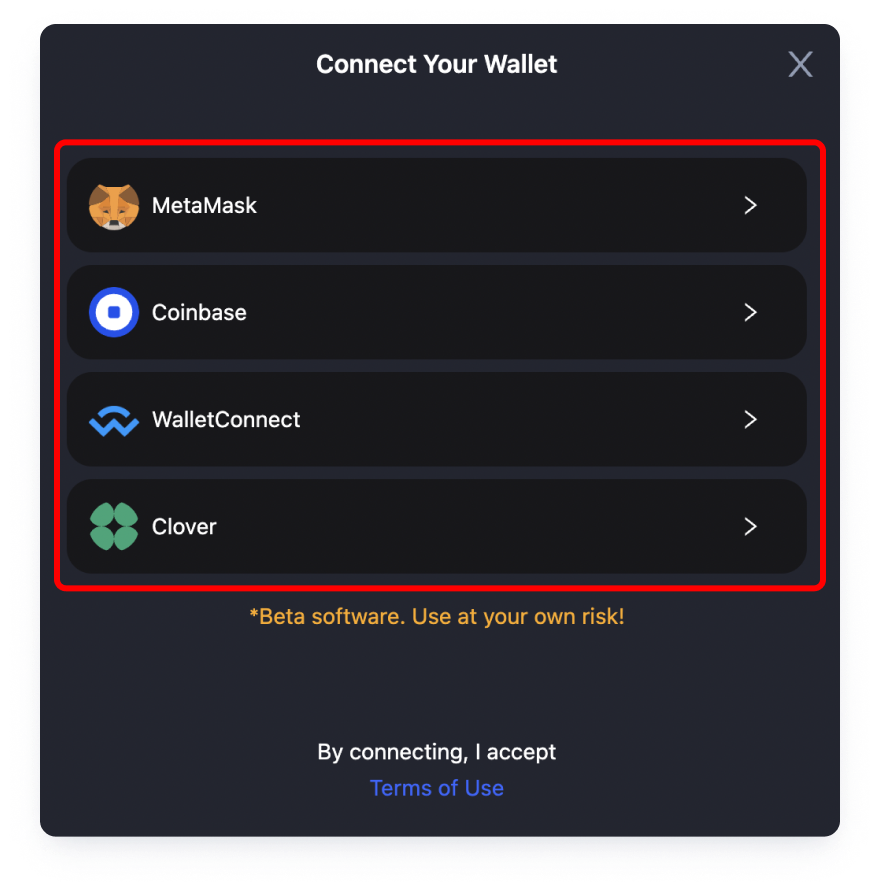

Connect your wallet by clicking on the “Connect Wallet” button above in order to begin your cross-chain transfer.

Step 2:

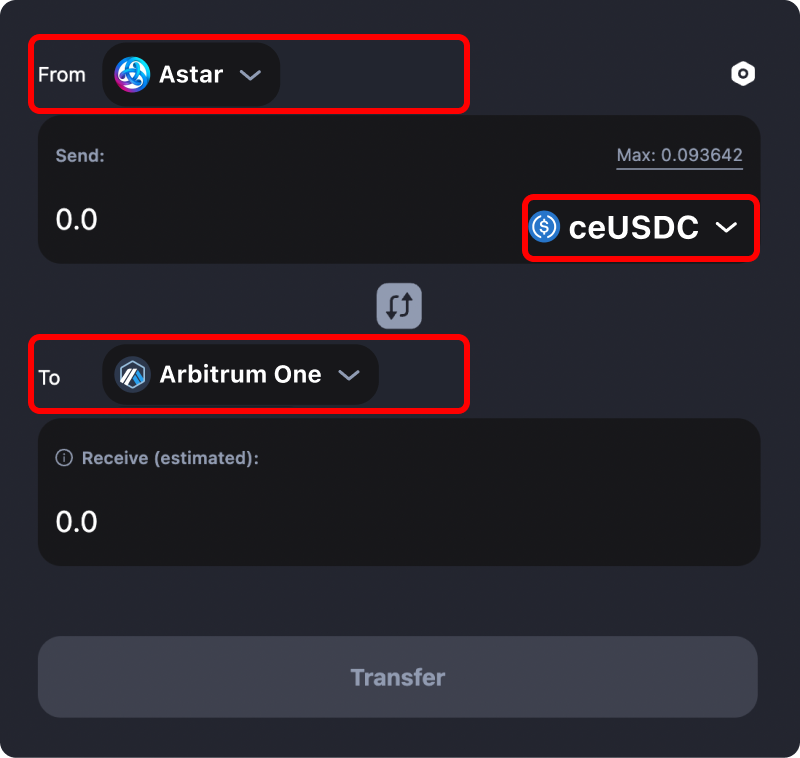

Select “Astar” in the “From” dropdown menu, select “Arbitrum One” in the “To” dropdown menu, and then select the asset type you wish to bridge to Arbitrum.

Please Note: You will have to switch your wallet’s network to Astar Network in order to perform the cross-chain bridging of your selected token from Astar to Arbitrum.

Step 3:

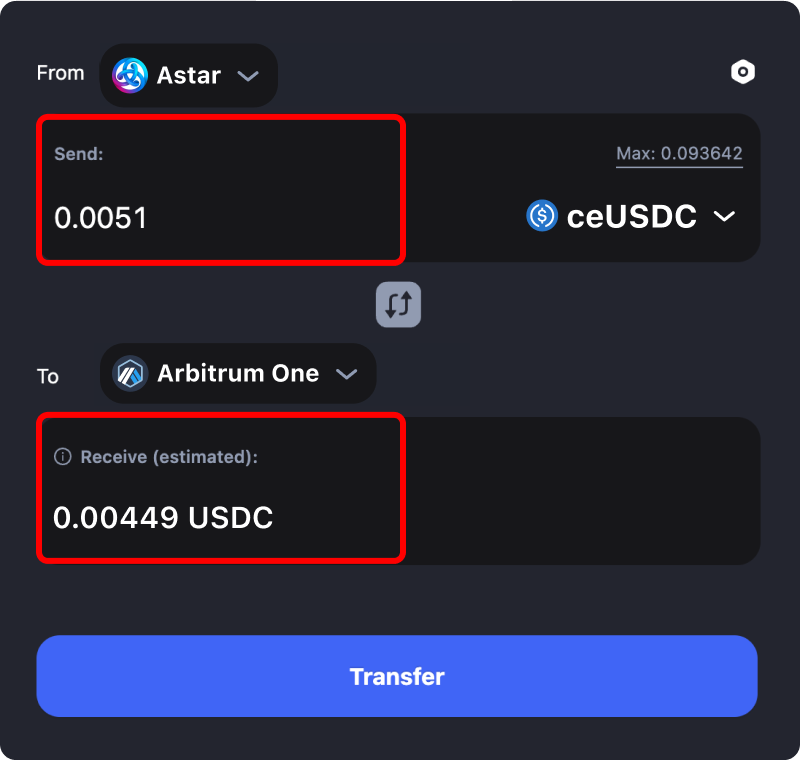

Input the amount of the token you selected that you would like to transfer from Astar to Arbitrum in the “Send:” field. The estimated amount of that asset that is to be bridged to Arbitrum will be displayed in the “Receive (estimated)” field.

Step 4:

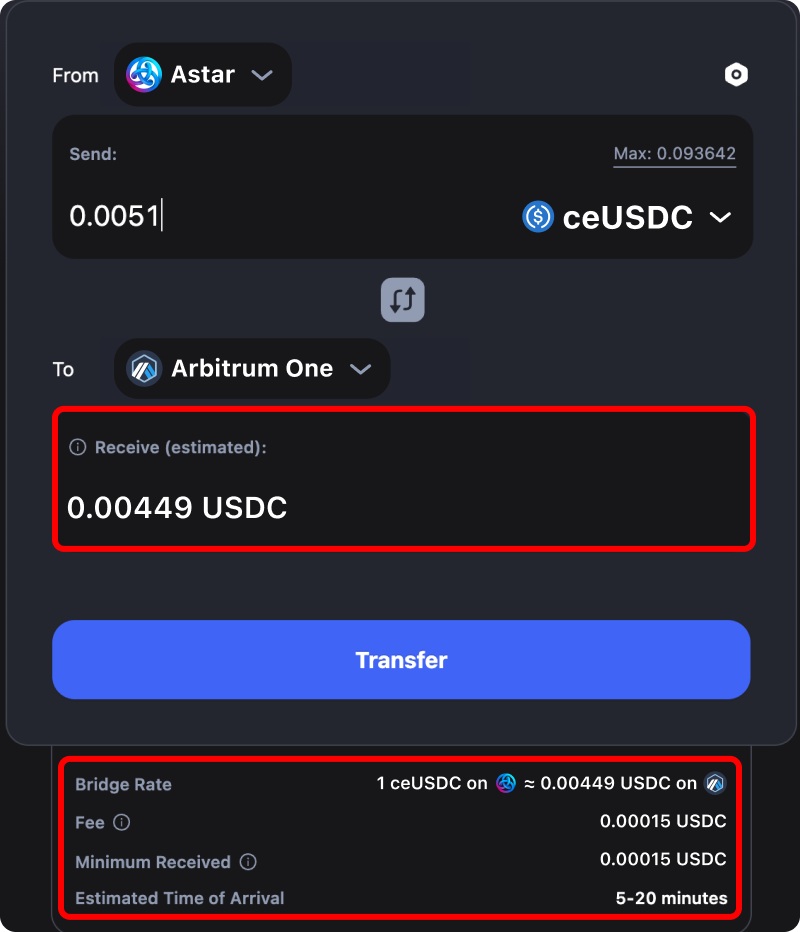

Review all of the Arbitrum bridge transfer information and cost estimates. If all of the cross-chain bridging transaction information is correct and acceptable, click the “Transfer” button and approve the transaction prompts to begin the cross-chain transfer.

Step 5:

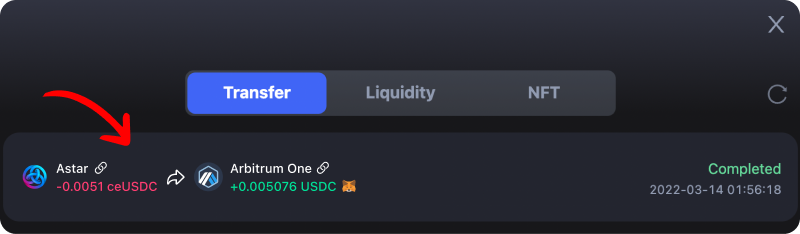

Wait for your cross-chain bridge transaction to Arbitrum to complete. You will then receive your bridged tokens on Arbitrum.

Please Note: Most cross-chain transfers are completed almost instantaneously, however some may take as long as 20 minutes to complete depending on how much traffic the chain is experiencing.

If you wish to see more details about the bridge transaction from Astar to Arbitrum, you can click the links in your “Transfer History” tab.

For a more in-depth step-by-step guide on cross-chain transfers and crypto bridging see our full tutorial here:

https://cbridge-docs.celer.network/tutorial/cross-chain-transfer

Astar Network Information

Rebranding itself from Plasma to Astar Network in 2021 with a greater vision to support its ecosystem, Astar Network is a multiple blockchain dApp hub that offers dApps staking, L2 solutions, and a cross virtual machine that supports EVMs.

Astar Network is composed of several major components working together including Polkadot, to facilitate cross chain communication. Astar is considered the Polkadot version of Shiden Network for Kusama. Parachains are also used to connect independent blockchains to the Polkadot ecosystem. Astar also supports crowd loans to help fundraise for a parachain slot within the Polkadot ecosystem.

ASTR token is the native and governance token of the Astar Network. ASTR tokens are used for staking directly on Astar dApps.

ASTAR / (ASTR) Current Information

Description

Similar to many popular blockchains, ASTR is the native token for the Astar Network for transaction on-chain fees. The ASTR token has 3 other utilities including (1). Facilitating governance activities like voting and referenda, (2). Staking on different decentralized applications and the network itself, while earning ASTR tokens as rewards, (3) layer 2 networks and applications can deposit ASTR on their respective Layer 1s in creating layer 2 applications that can support omnichain general message and liquidity passing.

Celer’s cross-chain bridge, cBridge, supports the cross-chain bridging of ASTR ![]() between multiple chains with the fastest speeds, lowest costs, and most secure transactions available. The full name of this asset is ASTAR and the ticker of this asset is ASTR.

between multiple chains with the fastest speeds, lowest costs, and most secure transactions available. The full name of this asset is ASTAR and the ticker of this asset is ASTR.

Arbitrum Information

Arbitrum is a layer 2 solution for Ethereum supporting dApps by aiming to bring scalability and affordable transactions for Ethereum network users. To enable this, Arbitrum uses “Optimistic Rollup,” meaning Arbitrum allows every validator to post a rollup block that they claim is correct with a 7 day window to dispute this block as there is complete transparency of transactions. An optimistic rollup executes transactions on layer 2 and then submits the transaction data to layer 1, in this case to the Ethereum Mainnet. Since Arbitrum is interacting with the Ethereum Mainnet, all transaction fees are paid in Ethereum.

When making asset withdrawals from Arbitrum to Ethereum Mainnet, cBridge offers the finality within 5~20 minutes and delivers this at 50% less gas fees than the native bridge.

Ether /Ethereum (ETH) Current Information

Description

Ether (ETH), also referred to as Ethereum, is the main decentralized cryptocurrency used when dealing with Ethereum Mainnet and its various layer-2s like Arbitrum and Optimism. Simply put, it is the currency of when interacting with Ethereum Mainnet or its layer-2s. Whether you want to simply transfer some ETH between wallets, use ETH as collateral for creating an entirely new token, receive some bridged tokens from another chain like Polygon, or use an application someone had built on Ethereum; anytime you interact with Ethereum you will be required to pay a small fee in ETH.

Our cross-chain bridge, cBridge, supports the cross-chain bridging of Ether (ETH) ![]() between multiple chains with the fastest speeds, lowest costs, and most secure transactions available. The full name of this asset is Ether and the ticker of this asset is ETH.

between multiple chains with the fastest speeds, lowest costs, and most secure transactions available. The full name of this asset is Ether and the ticker of this asset is ETH.

What is a Blockchain/Crypto Bridge?

Blockchain or Crypto bridges work just like the real thing, but instead of connecting physical places together, they are used to connect digital ecosystems together. These bridges can pass both information and assets between the bridged blockchains. We call this a cross-chain transfer.

As an example, if you have a need to use a token on Arbitrum, and you have that token on Astar Network and not on Arbitrum, you could either deposit more of that token specifically on Arbitrum, or you could find an Arbitrum bridge that will bridge that from Astar Network to Arbitrum so you do not have to spend more to get additional tokens just because it is on Arbitrum.

There are also different types of bridging in terms of how the cross-chain transfer is done from a technical standpoint. There is liquidity-based bridging where there are liquidity pools of an asset on both the source and destination blockchains. There is also canonical-based bridging where an asset is locked on the source chain and a new asset that represents that locked asset is created on the destination chain.

Bridging and cross-chain transfers are not limited to just normal assets or fungible tokens either. Bridges can transfer and move non-fungible tokens (NFTs) between chains as well. cBridge supports 2 main models when it comes to NFT bridging, pegged NFT bridging and multi-chain native (MCN) NFT bridging. Pegged NFT bridging is similar to the canonical-based bridging mentioned above. The NFT is locked on the source chain and a new NFT that represents that locked NFT is created, or minted, on the destination chain. In the MCN NFT bridging model, however, a MCN NFT does not have the notion of “origin chain” or "original NFT". When transferring an MCN NFT from chain A to chain B, the only pattern is "Burn-and-Mint" so that there is always only one NFT across all of the chains.

Then there are the different levels of “trust” you can have in a crypto bridge. The two main types are trusted and trustless bridges. Trusted bridges depend on a central system or entity and require you to put your trust in them if you wish to use their bridge. Trustless bridges, like our own cBridge, are completely controlled by and run on automated smart contracts and algorithms that have the same security and stability as the blockchain itself.

Things start to get a more complex from there so if you are interested in learning more about the different types of bridges and the tech behind them, you can read through our documents here: https://cbridge-docs.celer.network/

What are the Benefits of Using a Blockchain/Crypto Bridge?

There are many reasons you may want to use a bridge to do a cross-chain transfer between different blockchains:

Lower transaction fees

You can take advantage of platforms with lower transaction fees and higher speeds when compared to more congested chains, like Ethereum Mainnet. Especially when exploring different decentralized applications (dApps). You can look at alternative chains, like BNB Chain, and bridge whatever asset you wish to bridge, from Ethereum to BNB Chain. You can then get some of that chain’s utility token and will be able to enjoy the lower transaction fees and higher speeds afforded to chains like BNB Chain.

Take advantage of other dapps and opportunities on different blockchains

If you’ve been providing liquidity for lending out a certain token on Astar Network, but see that the interest rate for lending that token on Arbitrum is significantly higher; you can use a cross-chain transfer to move your tokens from Astar Network to Arbitrum in order to take advantage of that higher interest rate.

Explore other blockchain ecosystems

The Web3 world is growing fast and you now have more options than ever before when it comes to different blockchains and dApps on those chains. There are many different compelling reasons why developers are building on the chains they are and with all of this diversity it makes it difficult to select a chain to invest in. Bridges and cross-chain transfers help solve this issue. By giving you the ability to bridge assets like ETH, USDT, USDC, and BTC to different chains, this opens up your options when it comes to being able to explore alternate L1 chains and the native dapps and services that they provide.