How to Bridge from Kava Network to Ethereum Mainnet

Celer cBridge makes it quick, easy, and secure to bridge assets like USDT, USDC, and more from Kava Network to Ethereum Mainnet and from Ethereum Mainnet to Kava Network by following these simple steps:

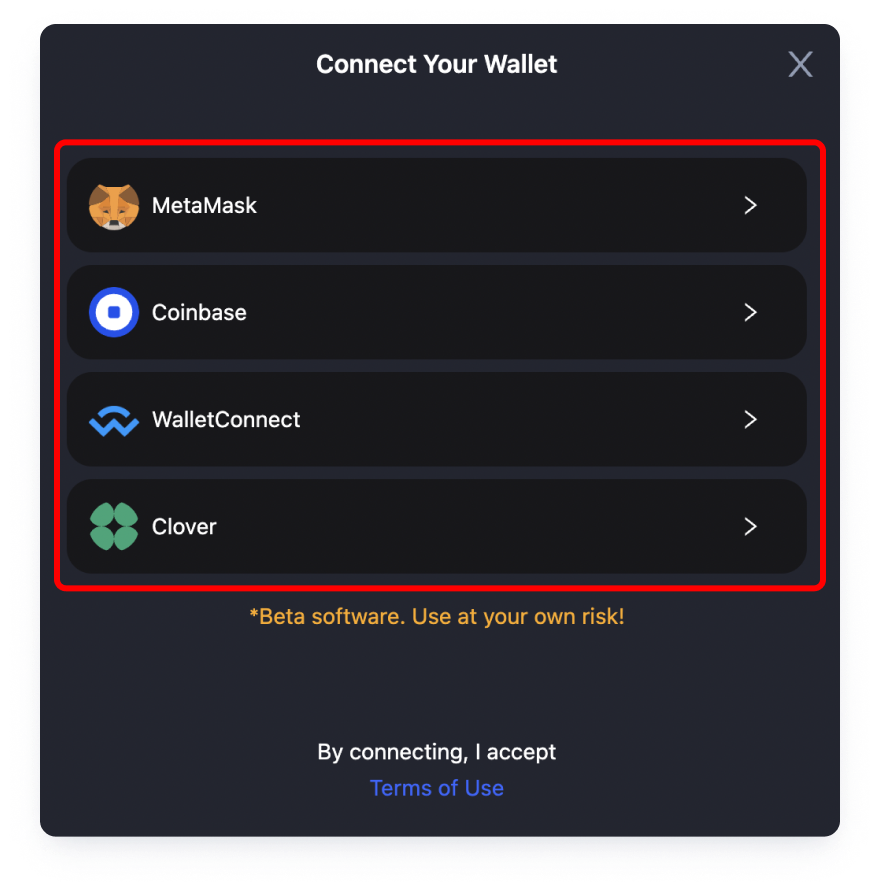

Step 1:

Connect your wallet by clicking on the “Connect Wallet” button above in order to begin your cross-chain transfer.

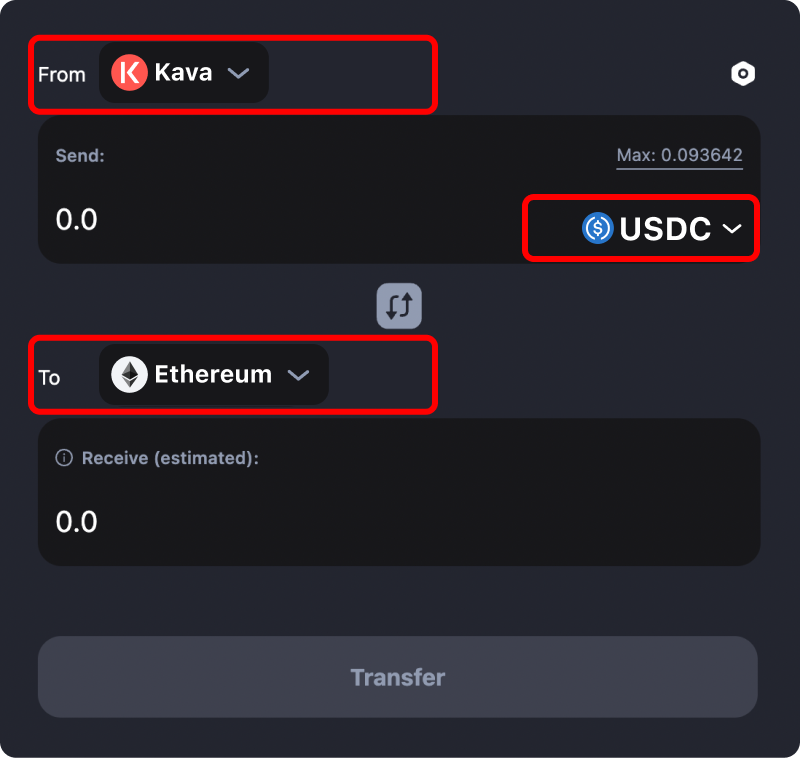

Step 2:

Select “Kava EVM Co-Chain” in the “From” dropdown menu, select “Ethereum Mainnet” in the “To” dropdown menu, and then select the asset type you wish to bridge to Ethereum.

Please Note: You will have to switch your wallet’s network to Kava Network in order to perform the cross-chain bridging of your selected token from Kava to Ethereum.

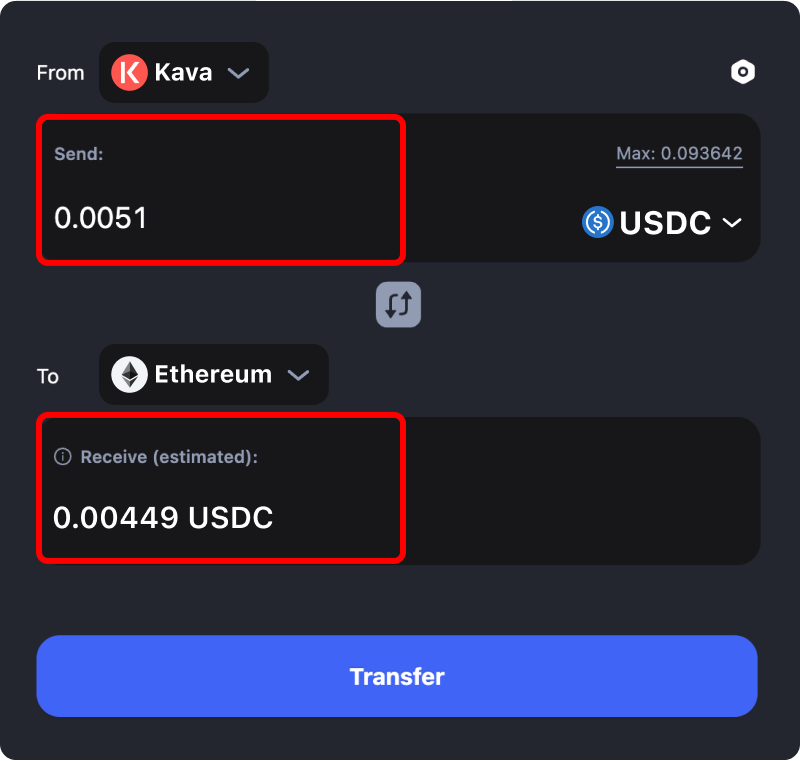

Step 3:

Input the amount of the token you selected that you would like to transfer from Kava to Ethereum in the “Send:” field. The estimated amount of that asset that is to be bridged to Ethereum will be displayed in the “Receive (estimated)” field.

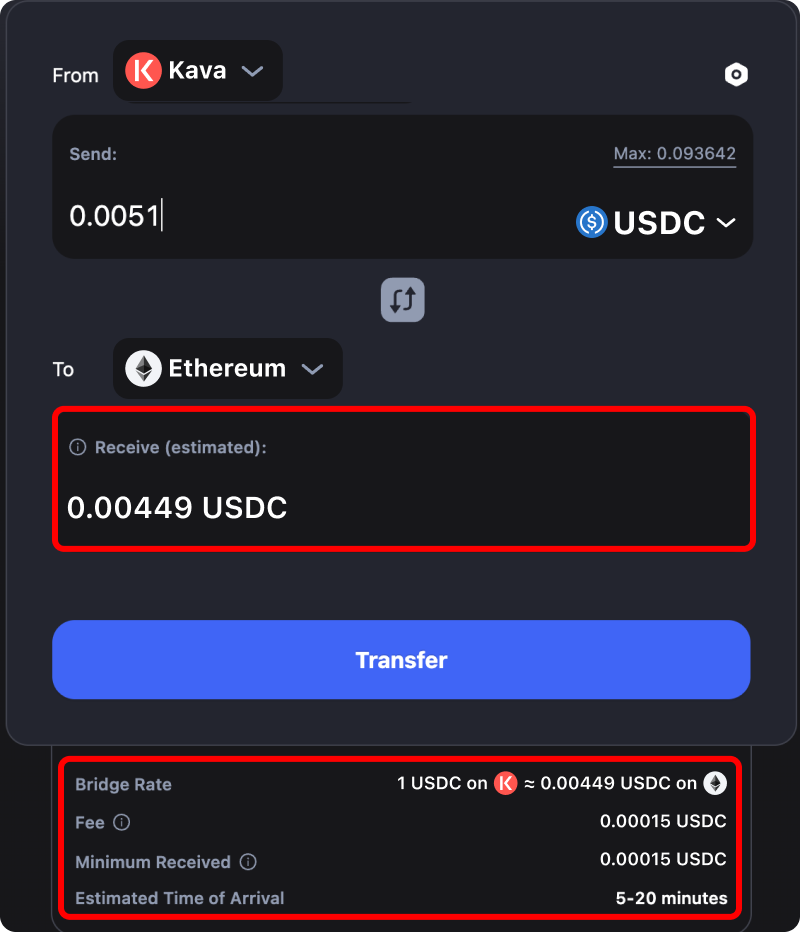

Step 4:

Review all of the Ethereum bridge transfer information and cost estimates. If all of the cross-chain bridging transaction information is correct and acceptable, click the “Transfer” button and approve the transaction prompts to begin the cross-chain transfer.

Step 5:

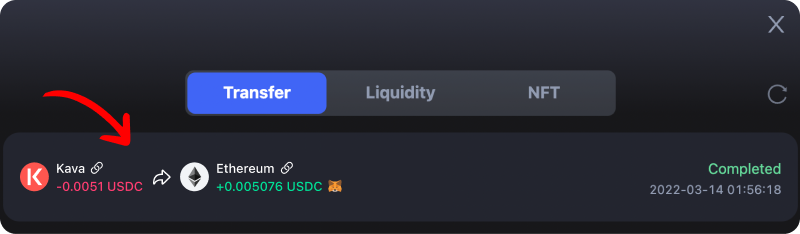

Wait for your cross-chain bridge transaction to Ethereum Mainnet to complete. You will then receive your bridged tokens on Ethereum.

Please Note: Most cross-chain transfers are completed almost instantaneously, however some may take as long as 20 minutes to complete depending on how much traffic the chain is experiencing.

If you wish to see more details about the bridge transaction from Kava to Ethereum, you can click the links in your “Transfer History” tab.

For a more in-depth step-by-step guide on cross-chain transfers and crypto bridging see our full tutorial here:

https://cbridge-docs.celer.network/tutorial/cross-chain-transfer

Kava Network Information

Empowering the next wave of developers in creating the next generation of blockchain technology, the Kava Network is a Layer-1 blockchain that combines the speed and scalability of the Cosmos SDK with the developer support of Ethereum through its unique co-chain architecture. Kava focuses on interoperability to bring together the Ethereum and Cosmos Co-Chain ecosystems, while optimizing the scalability to enable less friction for the flow of users, assets, and projects alike—as it is powered by the Tendermint Core consensus engine.

KAVA is the governance token of the Kava Network and can also be staked by validators or delegated to validator nodes. Stakers and delegators earn a portion of the network's fees as a reward for securing the network and also have voting rights in network governance proposals.

Kava / (KAVA) Current Information

Description

The Kava protocol facilitates a peer-to-peer lending protocol where users can lock their funds in smart contracts. Then those contracts mint new USDX tokens that users can take as a loan based on collateral. Much like other blockchains, Kava’s native token, KAVA, is utilized to facilitate governance voting to help guide the network upgrades and enhancements, including parameters related to collateralized debt positioning system. The token is used additionally to help maintain the network’s security by allowing holders to validate blocks and stake on various applications.

With a function to serve as a reserve, the network will mint new KAVA to utilize in the purchase of USDX if USDX becomes over collateralized, allowing Kava to ensure its stablecoin retains its value.

Celer’s cross-chain bridge, cBridge, supports the cross-chain bridging of KAVA ![]() between multiple chains with the fastest speeds, lowest costs, and most secure transactions available. The full name of this asset is Kava token and the ticker of this asset is KAVA.

between multiple chains with the fastest speeds, lowest costs, and most secure transactions available. The full name of this asset is Kava token and the ticker of this asset is KAVA.

Ethereum Mainnet Information

Ethereum is a decentralized blockchain platform that provides open access to digital money and data-friendly services. It is a community-built technology that is responsible for Ether (ETH) also referred to as Ethereum, as well as many different decentralized applications (dApps) that many people use today. With their tools and unique programming language, Solidity, Ethereum’s users can create, publish, monetize, and use applications on the platform, while using its Ether (ETH) cryptocurrency as payment. Ethereum allows you to move money, or make agreements, directly with someone else while serving as a decentralized public ledger for verifying and recording those transactions.

Ether /Ethereum (ETH) Current Information

Description

Ether (ETH), also referred to as Ethereum, is the main decentralized cryptocurrency used when dealing with Ethereum Mainnet and its various layer-2s like Arbitrum and Optimism. Simply put, it is the currency of when interacting with Ethereum Mainnet or its layer-2s. Whether you want to simply transfer some ETH between wallets, use ETH as collateral for creating an entirely new token, receive some bridged tokens from another chain like Polygon, or use an application someone had built on Ethereum; anytime you interact with Ethereum you will be required to pay a small fee in ETH.

Our cross-chain bridge, cBridge, supports the cross-chain bridging of Ether (ETH) ![]() between multiple chains with the fastest speeds, lowest costs, and most secure transactions available. The full name of this asset is Ether and the ticker of this asset is ETH.

between multiple chains with the fastest speeds, lowest costs, and most secure transactions available. The full name of this asset is Ether and the ticker of this asset is ETH.

What is a Blockchain/Crypto Bridge?

Blockchain or Crypto bridges work just like the real thing, but instead of connecting physical places together, they are used to connect digital ecosystems together. These bridges can pass both information and assets between the bridged blockchains. We call this a cross-chain transfer.

As an example, if you have a need to use USDT on Ethereum Mainnet, and you have USDT on Kava Network and not on Ethereum Mainnet, you could either deposit more USDT specifically on Ethereum Mainnet, or you could find a Ethereum bridge that will bridge your USDT from Kava Network to Ethereum Mainnet so you do not have to spend more to get additional USDT just because it is on Ethereum.

There are also different types of bridging in terms of how the cross-chain transfer is done from a technical standpoint. There is liquidity-based bridging where there are liquidity pools of an asset on both the source and destination blockchains. There is also canonical-based bridging where an asset is locked on the source chain and a new asset that represents that locked asset is created on the destination chain.

Bridging and cross-chain transfers are not limited to just normal assets or fungible tokens either. Bridges can transfer and move non-fungible tokens (NFTs) between chains as well. cBridge supports 2 main models when it comes to NFT bridging, pegged NFT bridging and multi-chain native (MCN) NFT bridging. Pegged NFT bridging is similar to the canonical-based bridging mentioned above. The NFT is locked on the source chain and a new NFT that represents that locked NFT is created, or minted, on the destination chain. In the MCN NFT bridging model, however, a MCN NFT does not have the notion of “origin chain” or "original NFT". When transferring an MCN NFT from chain A to chain B, the only pattern is "Burn-and-Mint" so that there is always only one NFT across all of the chains.

Then there are the different levels of “trust” you can have in a crypto bridge. The two main types are trusted and trustless bridges. Trusted bridges depend on a central system or entity and require you to put your trust in them if you wish to use their bridge. Trustless bridges, like our own cBridge, are completely controlled by and run on automated smart contracts and algorithms that have the same security and stability as the blockchain itself.

Things start to get a more complex from there so if you are interested in learning more about the different types of bridges and the tech behind them, you can read through our documents here: https://cbridge-docs.celer.network/

What are the Benefits of Using a Blockchain/Crypto Bridge?

There are many reasons you may want to use a bridge to do a cross-chain transfer between different blockchains:

Lower transaction fees

You can take advantage of platforms with lower transaction fees and higher speeds when compared to more congested chains, like Ethereum Mainnet. Especially when exploring different decentralized applications (dApps). You can look at alternative chains, like BNB Chain, and bridge your USDC, or whatever other asset you wish to bridge, from Ethereum to BNB Chain. You can then get some of that chain’s utility token and will be able to enjoy the lower transaction fees and higher speeds afforded to chains like BNB Chain.

Take advantage of other dapps and opportunities on different blockchains

If you’ve been providing liquidity for lending out USDC on Kava Network, but see that the interest rate for lending USDC on Ethereum Mainnet is significantly higher; you can use a cross-chain transfer to move your USDC from Kava Network to Ethereum Mainnet in order to take advantage of that higher interest rate.

Explore other blockchain ecosystems

The Web3 world is growing fast and you now have more options than ever before when it comes to different blockchains and dApps on those chains. There are many different compelling reasons why developers are building on the chains they are and with all of this diversity it makes it difficult to select a chain to invest in. Bridges and cross-chain transfers help solve this issue. By giving you the ability to bridge assets like ETH, USDT, USDC, and BTC to different chains, this opens up your options when it comes to being able to explore alternate L1 chains and the native dapps and services that they provide.